GOVERNMENTS/ASSOCIATIONS/FASTENER GROUPS

Interview with Global Fastener Associations Presidents

Add to my favorite

2022-11-24

In around a month or more we’ll soon reach the end of 2022. This year, the global industry confronted with several unexpected challenges, pushing various businesses to find out their own advantages and disadvantages more seriously and looking for possibilities and opportunities to increase their market competitiveness and catch up with market trends. While speaking for the interest of their association members and the entire industrial supply chains, many association presidents have also noticed lots of industrial trends focused this year.

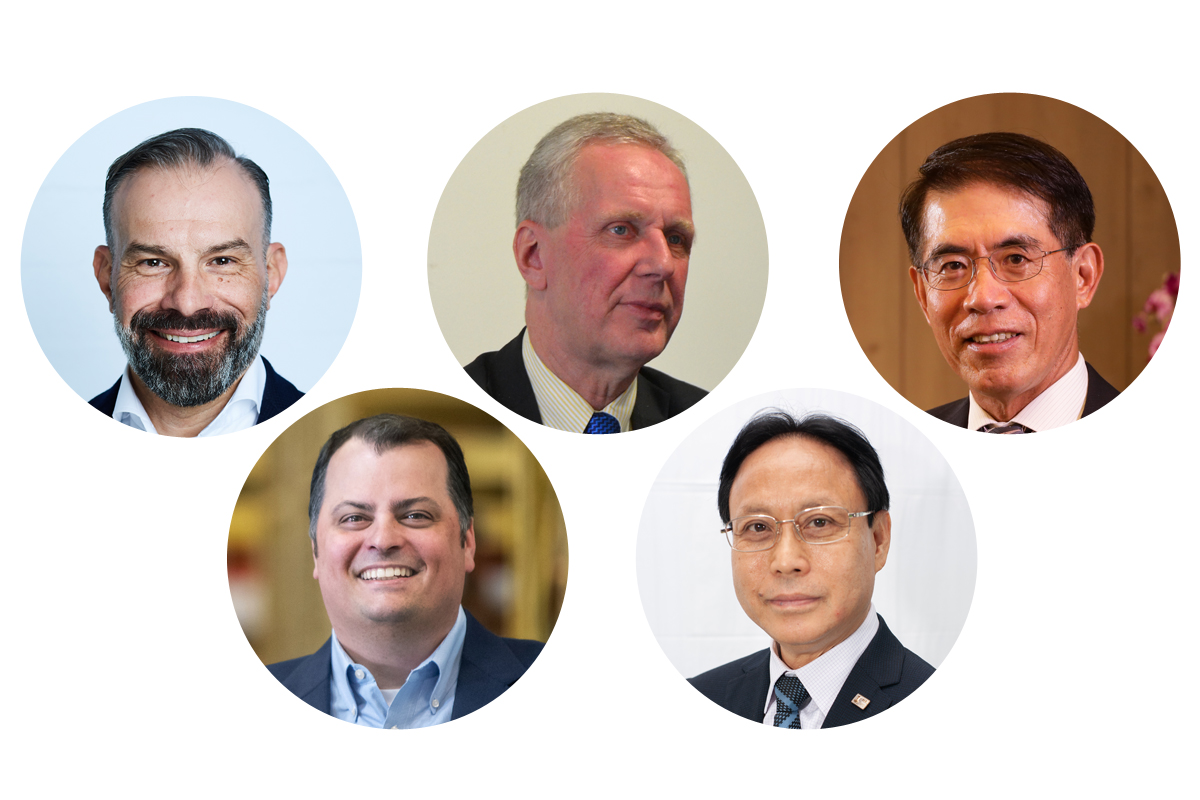

As a result, in this issue we are very pleased to have:

European Fastener Distributors Association (EFDA) President Andreas Bertaggia

National Fastener Distributors Association (NFDA) President Nick Ruetz

European Industrial Fasteners Institute (EIFI)

President Anders Karlsson

Taiwan Fastener Trading Association (TFTA)

President Josh Chen

Hong Kong Screw and Fastener Council (HKSFC)

Chairman Tsui Ping Fai

to spend some of their precious time sharing with the global and local fastener industry their review of the industrial development in 2022 and their expectation and outlook for 2023.

◆ To review the first 9 months of 2022, what major challenges do you think are faced by the global fastener industry?

EFDA: We are currently facing an unimaginable number of challenges, something we have hardly experienced in the past. It starts with the general price inflation of fasteners and the long lead times that present our industry with a huge challenge in terms of disposition and availability. Then there are many uncertainties on a geopolitical level such as the Ukraine war, the tensions between China and the USA with regard to Taiwan, the energy crisis, the possible recession after extremely good times, the labor shortage and the many regulations that will continue to come our way in the near future, such as ESG issues. I don't think we can complain that our industry is not sufficiently challenged and that it will be boring in the coming months and years.

NFDA: Inventory, Freight, and Inflation. I believe distributors fall into two categories. Those who got ahead of the lengthened lead times and transportation delays and are now flush with inventory, and those who are still trying to catch up. The inflationary impacts on our industry when you include freight expense both over the ocean and inland domestically have been a challenge to manage and hold margins.

TFTA: The world is no doubt full of challenges this year. The Russia-Ukraine war launched this April, the pandemic that seems to ease but continuously influence our life, and U.S. Fed’s interest rate increase (as a major challenge) all resulted in a more chaotic world economy. Dollar becomes stronger against New Taiwan Dollar (NTD) and other currencies, making hot money flow into the U.S. and reducing investors’ will to invest more. The stagnant economy will definitely cause challenges and more or less influence our businesses, not to mention the conjecture that US. Fed may increase the rate again. Although the depreciation of NTD is favorable to our export, currencies of other countries such as S. Korea, China, etc. also depreciate and the same competition remains there. The appreciation of USD is aimed at holding inflation back, however, we’re currently not sure whether it will work or not as several uncertainties remain.

EIFI: Of course, the war in Ukraine has changed a lot in the economy for everyone. Rising energy prices, steel costs, transport costs have been a test for the industry. To that comes rising labour rates with demand of more than 8% by IG Metall in Germany and more will follow in other countries, we are back to a situation that faced us in the 1980s with high general inflation. This is a major challenge for the industry to handle and every company must fight this.

HKSFC: 2022 is absolutely an extraordinary year. Geopolitical issues, rigorous world situations, hiking raw material prices, strong US dollar, as well as influences from the Covid-19 pandemic have all generated significant impacts on the global fastener industry.

◆ Is there any significant impact caused by these challenges on the region your association represents?

EFDA: The energy crisis on the European continent and the accompanying price inflation with all its measures will have a big impact on our industry. We do hope we don’t have to deal with plant shutdowns due to electricity or gas shortages. What measures are our members taking to secure their pipelines and the availability of their products for their customers? In general, we see rising costs everywhere due to the currency weakness, price inflation and increasing labor salaries and so on. And when the recession comes, members have to expect higher costs with lower revenues. This could result in higher pressure on their profit margins. As I mentioned earlier, the ESG regulation is bringing new challenges to our businesses in the short term, which will impact many of our suppliers along the supply chain.

NFDA: The biggest impact has been on margins to most distributors. Customers know that material costs are up, but the impact from material costs for fasteners as opposed to things like castings or machined parts is much greater. Second, the impacts of ocean freight expense have also been difficult to explain to customers since fastener distributors max out containers on weight far in advance of space. There is also not a consistent or common index for freight that includes rail or freight expense from the ports to inland destinations.

TFTA: These challenges along with a weakened economy reduced orders. Some customers also asked their suppliers to delay shipments, thus deferring the preparation of circulating funds for their operation and indirectly giving them a hard time to pay for goods. However, Taiwanese companies always demonstrated strong flexibility in dealing with these matters. Taiwan fastener industry saw an explosive growth in order acceptance in the 1st half of 2022, which, however, dropped again in May-June, creating a situation in which some companies are only processing previously made backlogs and see decreasing future demand. Taiwan’s exports to both Europe/USA and the rest of the world showed a significant drop and there is no obvious sign of recovery at this moment, so more time is needed to observe its development. Although a few companies once said that they had seen their order acceptance fully booked through this August or September, I personally think that a different scenario is still likely to appear.

HKSFC: The aforementioned impacts have caused tremendous influences on our export and logistic activities, which led to continuous surge of production costs, especially amid the pandemic.

◆ Is the impact being solved or has it been solved to achieve satisfying improvement or acceptable results?

EFDA: I would say we are in the middle of it and the outcome is anything but clear. I guess that our industry and our members need to deal with these problems on a daily basis. This means being alert and flexible to adapt to the circumstances.

NFDA: Things are improving, but the slowdown in the economy has made the improvement less noticeable as companies are now faced a new set of challenges.

TFTA: With eased pandemic, loosened border control of Taiwan, and the gradually relaxed pandemic control measures of other countries, Taiwanese companies show higher interest in soliciting business overseas. Not long ago, Taiwan adopted strict border control policies, so people usually had to take around a month for their business trip (including the days of quarantine), thus greatly reducing their will to travel abroad. However, with face-to-face business interactions becoming more frequent now, even though the recent economy remains a significant drop and US dollar appreciated again, we may still expect to see more business collaboration via face-to-face communication abroad, which is absolutely better than via video conferences or phone calls. This can be also one of the ways to improve influences caused by the challenges.

EIFI: It’s an ongoing challenge for everyone and very uncertain situation.

HKSFC: Based on the current world situations and political scenarios, I personally don’t think that the economic conditions will be improved in the short term. What we hope now is the Covid-19 pandemic can come to an end as soon as possible, so people around the world can travel as usual and the economic and business environment will get better and better.

◆ The traditional but indispensable global fastener industry is going into a new wave of industrial upgrade & transformation. Does the fastener industry your association represents demonstrate any achievement in industrial upgrade & transformation that is worthy to be learned by its counterparts? On what type of upgrade & transformation is currently focused by the local industry your association represents?

NFDA: US distributors are starting to adopt automation and electronic customer portals to make information more readily available and at the fingertips of our customers. While production of fasteners and components don’t lend themselves to traditional eCommerce solutions the industry seems to be transforming itself to offer some of the same self-serve solutions that one can experience when making purchases online. Things like seeing real time inventory, retrieving their own invoices, submitting requests for quotes, and transferring prints or other documents.

EIFI: There are lectures and seminars arranged to keep the industry updated. The national organizations have different programs going on, some more and others less. EIFI will try in future to bring this up to European level and spread best practices more.

HKSFC: In order to grow bigger and stronger, we cannot help but upgrade ourselves and adopt automation to reduce the demand for labor force. By doing so, we can expect to achieve sustainable development and gain more favorable benefits.

◆ Compared to the fastener industry in other regions, in which area (e.g., product design, technology, service, industrial environment, standards & regulations, etc.) do you think the local industry your association represents is taking the leading position?

EFDA: One field where Europe definitely has a leading position is sustainability. Most likely, we have the most regulations to comply with compared to other regions. I believe that Europe is and will remain the leader here, while governments in other parts of the world will sooner or later follow the same or a similar path. The negative aspect is, of course, the regulations and standards that come along with it - here Europe is also taking a leading role. Naturally this causes a lot of administrative costs, efforts, and complexity nobody likes from a company’s' point of view. I also think that the European continent is taking a big step forward in terms of digitization and can observe that most companies are analyzing and defining their digitization strategies.

NFDA: I believe the US fastener distributor market leads the way on value added services. Whether that be Vendor Managed Inventory programs, value added/engineering services, or digital tools to help automate processes US distributors work hard to integrate into their customers supply chain rather than just be a supplier who takes purchase orders and delivers parts.

TFTA: Taiwan shows advantages in terms of technology & service, but it still needs to work harder in terms of int’l industrial collaboration. As a result, not only are Taiwanese companies working harder in this area, so are TFTA. In terms of services TFTA can provide for overseas customers and partnered associations (such as suppliers matchmaking and industrial intelligence), TFTA is also working on it. In terms of standards and requirements, some overseas customers would require finished products to be provided with complete treatments, but some Taiwanese suppliers are still struggling to meet their specific surface or electroplating treatments or feel the difficulty in acquiring special materials. Taiwanese suppliers preferred taking bulk orders to low-volume and customized ones before. Now, with the encouragement of Taiwanese government to companies to introduce Industry 4.0 and digitalized manufacturing, the demand for labors can be greatly reduced. However, this must depend upon companies’ budgets and their will to get involved, all of which require the government’s guidance or subsidies if necessary, as the higher the cost, the lesser interest of the companies. The investment in Industry 4.0 was high in the past, but now with more people willing to do this, the cost will get lower, increasing the companies’ will to invest in it. I hope that everyone must be quick and reinforce their strengths amid a slack season. TFTA also has the commitment to help companies get to know more, guide small enterprises to achieve partial transformation with lower cost, or assist in integrating many companies to reduce the cost. As many TFTA members are SMEs, they can rely upon us to learn more about industrial subsidies projects and we also expect to serve more TFTA members. TFTA will attend Taiwan International Intelligent Manufacturing Show in the end of Nov. After the show, TFTA management will discuss feasible ways to help members, such as sessions or orientations available for all members.

EIFI: Yes, I think so as long as we do not come in conflict with antitrust laws.

HKSFC: Hong Kong is an international metropolitan community. It is open to the world and takes lead in terms of talent pool and services. Supported by a variety of governmental funds and subsidies, small-to-medium sized enterprises in Hong Kong gain strengths to go toward the global market.

◆ Has such a leading position been favorable to the sustainability of the local industry your association represents and the collaboration with other international industry supply chains?

EFDA: Not yet. But since everyone, regardless of the industry, has to meet the same standards, I am sure that everyone within the supply chain has the same problems or needs. For this reason, I am sure that a certain service industry will emerge in this area to improve and ease everyone's problems. In this way, all stakeholders along the supply chain and across sectors are converging, because everyone has to meet the same standards.

NFDA: Yes, I believe with the supply chain disruptions it has offered more opportunity for distributors to manage parts directly for their customers that typically were purchased directly. The customers would rather have the buffer of inventory at the distributors warehouse, so they know it’s only a short distance away and ready on demand.

TFTA: Absolutely. Providing that digitalized manufacturing can be introduced, capacity can be more automated, and production efficiency can be enhanced, we can expect the defective rate to be lower. Taiwan is an island famous for its high technology and TSMC and other high-tech companies play a key role in supporting Taiwan’s economy, so does Taiwan fastener industry. Accordingly, if Taiwan fastener industry can go toward more advanced hi-tech and automated production, it won’t be difficult for it to acquire more relevant resources in the future.

EIFI: We certainly hope that it helps the industry especially in contact with governments and EU commission. One main task is to represent the industry interest in Brussels which is done in various ways.

HKSFC: With the endowment of various governmental funds, Hong Kong industries have successfully developed our own brands and demonstrated products at different tradeshows around the globe, helping sustain the development of European supply chains.

◆ In the collaboration with companies in other regions, is there any improvement you think Taiwanese companies can do more to satisfy the actual needs of customers ?

EFDA: As this big issue of ESG is coming and will not go away, it would help our industry a lot if the manufacturing industry would apply the ESG criteria. Because in the long run, suppliers have to meet many of the ESG criteria to continue to be listed as a supplier. All those who don't will have a hard time getting orders from customers in Europe.

NFDA: The biggest improvement I see is for Taiwan manufacturers to be more open to holding onto finished goods and have them available for release. While large manufacturers readily do this for distributors it is not widely adopted and could help keep parts being made in Taiwan.

TFTA: In terms of product design, industrial environment, regulations & standards, countries in the West are comparatively more complete and stricter, but Taiwan is gradually accelerating its steps to catch up. For example, we’re also making endeavors to deal with issues like green energy and carbon emission reduction, which have been discussed for a long period of time. Furthermore, in order to correspond with Taiwan’s “2025 Net-zero Transition” initiative and EU’s Carbon Border Adjustment Mechanism (CBAM) scheduled to take effect soon, TFTA has also organized a carbon emission reduction task force with Vice Chairman being the convener, which is aimed at guiding companies to understand governments’ relevant carbon emission reduction regulations/articles/policies as well as providing them with a list of units they can contact for consulting and support (such as MIRDC or units administered by Taiwan's MOEA), ensuring their compliance with measures when they come into force. On the other hand, this is not only for making companies understand the must-do in the future, but also for protecting the Earth with our own hands.

EIFI: We have some exchange with Taiwan organizations and we try to learn from each other.

HKSFC: Fastener industries in Southeast Asia and Taiwan in particular continue to grow further with remarkable advancements. We definitely should enhance the exchange and learn from industries in these regions. Hopefully, we can visit Taiwan and other regions for more inspections and interactions in the near future.

◆ As many tradeshows in Europe, America, and Asia (e.g., International Hardware Fair Cologne, International Fastener Expo) have come back with physical events since H2 2022, the face-to-face interaction amongst various industry sectors in the world will definitely become more frequent than before. How do you feel about this development?

EFDA: It is absolutely great that the so-called normal meetings will take place as we are used to. It is important to meet, discuss, exchange and work together. I can't wait to meet all the colleagues from our industry again.

NFDA: I believe in person, face to face meetings, are still an essential part of doing business. There is nothing that can replace shaking hands and looking each other in the eye when agreeing to do business together. I look forward to my next chance to get to Taiwan and visit with our key suppliers, and to meet new potential suppliers. I’m glad to see Fastener Fair, IFE, and the NFDA holding tradeshows and meetings in person again.

TFTA: I’m optimistic to such a development as face-to-face interaction is definitely good for doing business after all. I think doing business shouldn’t be just for doing business, sometimes customers can be like friends and exchanging conventional greetings with each other is also a kind of pleasure. Of course, exhibiting overseas can not only create business opportunities, but also can help us learn more about int’l market trends and overseas industrial development and appreciate others’ innovative products to win over more business for ourselves and keep pace with the market. I expect that I’ll have more opportunities to visit overseas markets. I also expect that, with Taiwan opening the border and industrial interaction being more frequent, the Global Platform for Fasteners (GPF) co-held by TFTA, NFDA, and EFDA can be soon held again.

EIFI: Very good, it will be nice to meet all people again and to continue various cooperation.

HKSFC: The interaction among people in the world has gradually returned to normal and many show organizers have also started to give physical events again. Hopefully, with various exhibitions being held, the exchange and interactions among industries can become more vibrant and we can have a clear insight into the trends and understand thoroughly the market needs.

◆ What is your expectation and outlook for the industrial development in 2023?

EFDA: The world is facing so many challenges these days that I really hope we can all weather the various storms healthy enough to get to some kind of normalcy one day. The pressure on companies and societies is enormous and protracted. People need a period of relaxation and a normal situation again.

NFDA: My guess is that we will see softening in different end markets, but not at the same time. I think some industries like construction may slow more than others. There is still backlog in several industries who continue to be hurt by their supply chains. Even if demand slows, those industries will continue to produce to eliminate their backlog.

TFTA: The world economy is still declining and shows no sign of cease. I hope that the Russia-Ukraine War can come to an end as soon as possible and world peace can turn into reality to bring joyful life for us. What’s more important is that I hope that the U.S. Fed will not increase the interest rate again, so the economy can boom and people will be more willing to invest.

EIFI: Very uncertain due the factors in Q1, we will have a cold winter with energy shortages for sure and that will be very challenging for all of us.

HKSFC: I wish for world peace, prosperous business, and normal & continuous interaction and collaboration among countries in 2023 and look forward to seeing normal and booming exports, harmonious human communication, and smooth financial activities.

◆ Finally, could you please share the latest event calendar of your association in 2023 including dates and locations if they have been available to be shared?

EFDA: EFDA is planning to be present and hold internal meetings at the Fastener Fair Italy in November/December 2022 and at the Fastener Fair Global in Stuttgart in March 2023. Our next regular meeting of the Assembly of Delegates is scheduled for the autumn of next year.

NFDA: NFDA Executive Summit (November 9-11 2022 – Naples, FL), NFDA Annual Meeting (June 13-14 2023 – Chicago, IL), NFDA Executive Summit (October 25-27 – Scottsdale, AZ)

TFTA: TFTA will exhibit at Taiwan International Fastener Show in 2023 and we expect that representatives from U.S. National Fastener Distributors Association (NFDA), European Fastener Distributors Association (EFDA), European Industrial Fasteners Institute (EIFI), as well as other partnered associations based in South Africa, Brazil and Hong Kong will come visit Taiwan during the event. TFTA also plans to hold a welcome dinner and an innovative fastener-thematic costumes show in collaboration with the Dept. of Fashion Styling and Design Communication of Shih Chien University during the event, hoping to give a special event for overseas visitors that is not only about fasteners, but also full of Taiwan’s creativity and innovation. In addition to exhibiting, TFTA also plans to give overseas factory tours (e.g., visiting factories in Japan). The “Training Course for Fastener Forming Technicians” which has been held for times will also include more advanced courses. Other guidance & explanation sessions for digital and net-zero transition will be also included into our event calendar in due course.

EIFI: Sorry, but it has not been decided yet.

HKSFC: In 2023 we tentatively plan to give inauguration, four region fastener associations conference, exhibit at Germany, Japan, etc., and organize delegation to other regions for industrial inspection and exchange. However, the pandemic development and situations will play a critical role in determining whether these events or activities can take place or not. These events or activities will only become possible when there is no travel ban in force.

EFDA president Andreas Bertaggia

NFDA president Nick Ruetz

EIFI president Anders Karlsson

TFTA president Josh Chen

HKSFC Chairman Tsui Ping Fai

歐洲扣件經銷商協會理事長

美國扣件經銷商協會理事長

歐洲工業扣件協會理事長

台灣螺絲協會理事長

香港螺絲業協會主席

扣件

國際展會

惠達雜誌

匯達實業

外銷媒合

廣告刊登

螺絲五金

五金工具

紧固件

台灣扣件展

印度新德里螺絲展

越南河內螺絲展

墨西哥瓜達拉哈拉螺絲展

美國拉斯維加斯螺絲暨機械設備展

波蘭克拉科夫螺絲展

義大利米蘭螺絲展

德國司徒加特螺絲展

wire Dusseldorf

FASTENER FAIR INDIA

FASTENER FAIR VIETNAM

FASTENER FAIR MEXICO

FASTENER POLAND

FASTENER FAIR ITALY

FASTENER FAIR GLOBAL

FASTENER WORLD

READ NEXT

GOVERNMENTS/ASSOCIATIONS/FASTENER GROUPS

2022-12-13

Subscribe