Managing Director of FIJ: Japanese Fastener Industry Performance During 2014 & 2015

Japanese Fastener Industry Performance During 2014 & 2015

by Yoshikazu Oiso,

Managing Director of The Fasteners Institute of Japan (FIJ)

1. Introduction

This article will explore the Japanese fastener industry from 2014 to July 2015.

Briefly looking at the major changes in the Japanese economy, we can almost say that the structural challenge for Japan’s economy has emerged as an obvious problem.

In 2014, Japan’s economy demonstrated a trade deficit, stock price surge, and depreciated yen against appreciated US dollar, as a consequence of the government’s 3 major policies incl. quantitative easing, breakaway from deflation, and economic recovery. Although the government has tried to support manufacturing equipment upgrade, equipment investment and wage raise by means of JPY 1-trillion-worth of tax cut and JPY 5-trillion worth of economic counter-measures, the country still cannot get rid of the influence from the domestic industrial recession.

Then, if we look at the Japanese economy in 2015, the country is still trending towards low consumption, shrinking domestic demand, and dull export performance. It is generally considered that the final goal to reach a true economic recovery is still far away. On top of that, the slowdown in emerging countries and signs of their economic bubbling also make the recovery of Japanese economy an uneasy task.

2.Japanese Fastener Industry Condition in 2014

If we look at the automotive industry, the top source of demand for screws, the domestic capacity for 4 wheeled vehicles (passenger cars, trucks, and buses) in the full year of 2014 reached 9,774,558 units, which is 1.015 times the previous year’s record (9,630,181 units). Table 1 shows the capacity for 4 wheeled vehicles.

Table 1. The Capacity for 4 Wheeled Vehicles in 2014

Unit: Vehicle

|

Month |

Passenger Cars |

Trucks |

Buses |

Total |

|

Full Year |

8,277,070 |

1,357,654 |

139,834 |

9,774,558 |

|

Previous Same Period |

8,189,323 |

1,308,177 |

132,681 |

9,630,181 |

|

Year-on-Year Ratio (%) |

101.1 |

103.8 |

105.4 |

101.5 |

Next, we will look at the number of new housing starts. The number in 2014 decreased by 10%, compared to the previous year which was heavily affected by the surging consumption demand prior to consumption tax raise. Compared to 2012 when the effect of consumption tax raise did not exist, however, the number in 2014 increased by 1.1%. Table 2 shows the number of new housing starts.

Table 2. The Number of New Housing Starts in 2014

Unit: one house

|

Month |

Total |

Self-owned House |

House for Rent |

Residential Unit Distributed by the Government, Public Institutions or Companies |

House Built for Sale |

|

Full Year |

892,261 |

285,270 |

362,141 |

7,372 |

237,428 |

|

Previous Same Period |

987,254 |

352,841 |

369,993 |

5,272 |

259,148 |

|

Year-on-Year Ratio (%) |

90.4 |

80.5 |

97.9 |

139.8 |

91.6 |

As for metal products (such as general machines, cars, automatic machines) with demand for machine tools, they all demonstrate a recovering trend. Consequently, the total value of order intake in 2014, coupled with the increase in domestic and overseas demand, has increased by 35% from the previous year. Table 3 shows the order intake performance of machine tools.

Table 3. Order Intake Performance of Machine Tools in 2014

Unit: Million Yens

|

Month |

Domestic Demand |

Overseas Demand |

Total Value of Order Intake |

|

Full Year |

496,391 |

1,013,006 |

1,509,397 |

|

Previous Same Period |

400,803 |

716,246 |

1,117,049 |

|

Year-on-Year Ratio (%) |

123.8 |

141.4 |

135.1 |

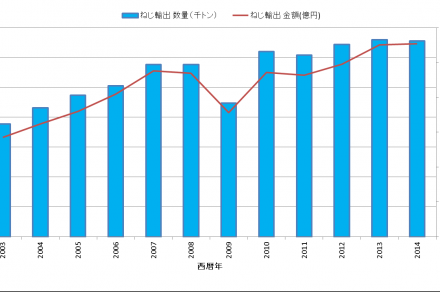

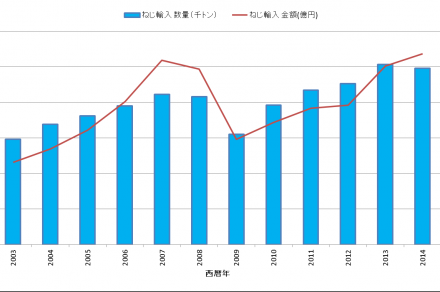

Excluding the machine tool industry, other primary industries that have demand for fasteners are seeing flat or weaker performance compared to the previous year. Regarding the fastener industry that reflects this tendency, The Fasteners Institute of Japan estimates the total fastener capacity of Japan in 2014 at around 2.94 million tons, a 2% increase from the previous year. The production value merely increase by 2.1% to 844 billion yens. Table 4 shows the capacity changes as of 2014; Table 5 shows the changes in export volume; Table 6 shows the changes in import volume.

3.The Japanese Fastener Industry in 2015

Before we finished this article, we still did not have enough data to confirm whether the total production for the full year of 2015 would be able to remain flat with the previous year. This is because the industry is still affected by the demand of clients.

As for the prospect for 4 wheeled vehicles in 2015, the capacity will land at 5 million units due to low domestic demand, whereas overseas production is expected to reach over 17 million units. Despite of that, if we look at the production performance during January-July 2015, the capacity reached 5,492,780 units (less than the previous year by 0.921 folds), which is an indication of severe situation. The number of new housing starts during January-July 2015 totaled 518,870 houses, a mere 2 % increase from the previous year, and thus we cannot assure that the number for the whole year will be able to reach 900 thousand units houses. The machine tools industry, with its value of order intake at 921,097 million yens (1.141 folds more than the previous year) during January-July 2015, is expected to see increased overseas demand. All clients are aware of these ups and downs of the industry, the Association thus expects that the industry to maintain flat performance with the previous year. (Editor’s note: Japan’s fastener capacity statistics will be released in spring of 2016.)

According to the Association’s sum of quick-release statistics, during January-June 2015 the Japanese fastener production volume reached 1,427,411 tons, and the production value reached 417,383,190,000 yens, which is a few percents down from the previous year.

Subscribe