News

San Shing to Go Back on Track Next Year After Operational Drop in Q3

Add to my favorite

2014-12-01

With less influence from the unfavorable factor like depreciated euro and with the advantage of depreciated Taiwanese dollar, a legal person pointed that San Shing’s gross profit margin in Q4 is expected to bounce back and the order intake of next Q1 will be better than that of Q4 this year, bringing the operation out of the bottom. On the other hand, the extra capacity of San Shing for dies and screws will be added on at the end of next quarter, so the legal person is looking forward to the back-to–normal revenue and EPS, under the support of newly added capacity and the static and unchanged capital stock.

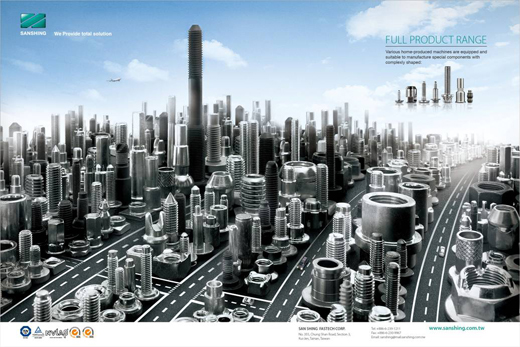

San Shing is the largest automotive nut manufacturer in the world. So far, nuts represent about 60% of its total revenue and 90% of its products are applied to the automotive industry; fasteners represent about 16% of its total revenue and the end users are mostly car manufacturers; the rest of proportion is of dies, coils, washers, wire, etc. San Shing tapped into the automotive fastener market in very early times. With the success of its gradual deployment in the automotive market and the emergence of Chinese automotive market, San Shing now acts as a T1 supplier rather than a T2 supplier, strengthening the current operation of the company. The operation of San Shing in the 1st half of this year grew steadily. However, as about 30% of San Shing’s revenue were calculated in euro, its gross profit margin in Q3 dropped to 22.64%, a slight decline from 24.31% of Q2, due to the great depreciation of euro. On the other hand, its EPS in Q3 dropped below NTD1 due to the currency exchange loss from non-operating recognition.

With the seasonal influence, San Shing’s shipments in Q4 are estimated to demonstrate a slight drop from Q3. However, as San Shing will adjust prices for customers every 3 months, the legal person thinks that the unfavorable factor of depreciated euro can be gradually mitigated. On the other hand, with the conditions of depreciated Taiwanese dollar and the price drop by China Steel Corp., the legal person is looking forward to a stable gross profit margin in Q4 for San Shing, whose profit in Q4 is very likely to outpace that in Q3. The shipments of San Shing in Q1 next year is expected to increase from Q4 this year and the operation will be back on track. In addition, San Shing’s new dies factory and the 1st phase of fastener factory are also expected to be operational by the end of Q1 and the beginning of Q2 next year. By then, the monthly fastener production will increase from 800 tons to 1,200 tons and the monthly production of dies will be also doubled. The legal person pointed that part of San Shing’s current capacity for dies is for internal operation while the rest of it is for sale. Every month the revenue lands at NTD40-50 million. There should be nice performance in growth next year based on customers’ demands.

Corresponding to the plan of capital expenditure this year, San Shing distributed a stock dividend of NTD1.5, which then caused the capital stock to expand to NTD2.681 billion, so the growth margin for EPS this year is thus limited. However, in 2015 San Shing will adopt the distribution of cash dividends, so it is expected that, without the continuous expansion of capital stock, San Shing’s EPS next year will grow to the previous level. San Shing’s EPS in the first three quarters was NTD3.01, so the legal person estimated that San Shing’s EPS this year should be around NTD4. In addition, San Shing’s growth margin of revenue next year is estimated to be over 10%, and the annual growth margin in profit is expected to be better than revenue.

扣件

國際展會

惠達雜誌

匯達實業

外銷媒合

廣告刊登

螺絲五金

五金工具

紧固件

台灣扣件展

印度新德里螺絲展

越南河內螺絲展

墨西哥瓜達拉哈拉螺絲展

美國拉斯維加斯螺絲暨機械設備展

波蘭克拉科夫螺絲展

義大利米蘭螺絲展

德國司徒加特螺絲展

FAIR INDIA

FASTENER FAIR VIETNAM

FASTENER FAIR MEXICO

FASTENER POLAND

FASTENER FAIR ITALY

FASTENER FAIR GLOBAL

FASTENER WORLD

READ NEXT

Subscribe