News

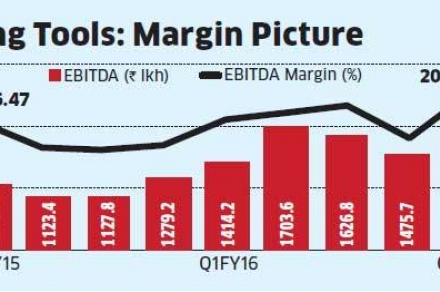

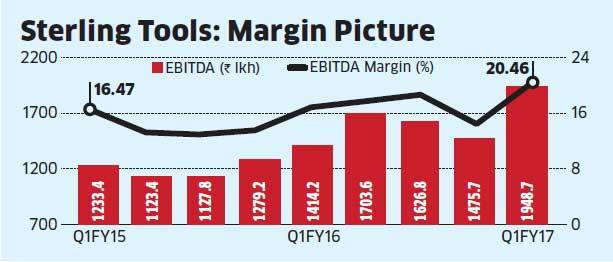

Sterling Tools, a supplier of fasteners to automobile companies, has expanded operating margin at a time when its peers are finding it difficult to do so. This can be attributed to Sterling's strategy of reducing reliance on single client and ability to fetch better prices for its products. Typically, in the auto ancillary segment, gain from lower commodity prices has to be passed to the automobile companies. However, Sterling Tools has been able to negotiate better terms with customer to retain a sizeable portion of benefits from fallen commodity prices (largely steel). This has helped the company to improve its margins consistently in the past eight quarters. In addition, Sterling Tools is increasing the proportion of its higher priced fasteners which are used in transmission, engine, and chassis. The fasteners used in engine and chassis are priced nearly 10-40 per cent more than standard fastener, and this product has few suppliers. Hence, it helps to boost average realisation. The company focuses on acquiring clients with a scope for scalability in the future.

As a result, the company has been focused on Honda Motorcycle & Scooter India (HMSI) in two-wheeler segment, Maruti Suzuki India among passenger car makers, Ashok Leyland in commercial vehicles and Mahindra & Mahindra in the farm equipment segment. These customers are one of the fastest growing in their segment, which helps in maintaining volume growth. In the past 18 months, the company has been able to increase its share of business from Maruti Suzuki to 40 per cent from 33 per cent earlier. The company's diverse portfolio makes it less vulnerable to the demand slack in any of these segments. To maintain volume growth, Sterling is putting up a new facility in Gujrat to cater to new plants of HMSI and Maruti with an investment of Rs 40-50 crore.

Subscribe