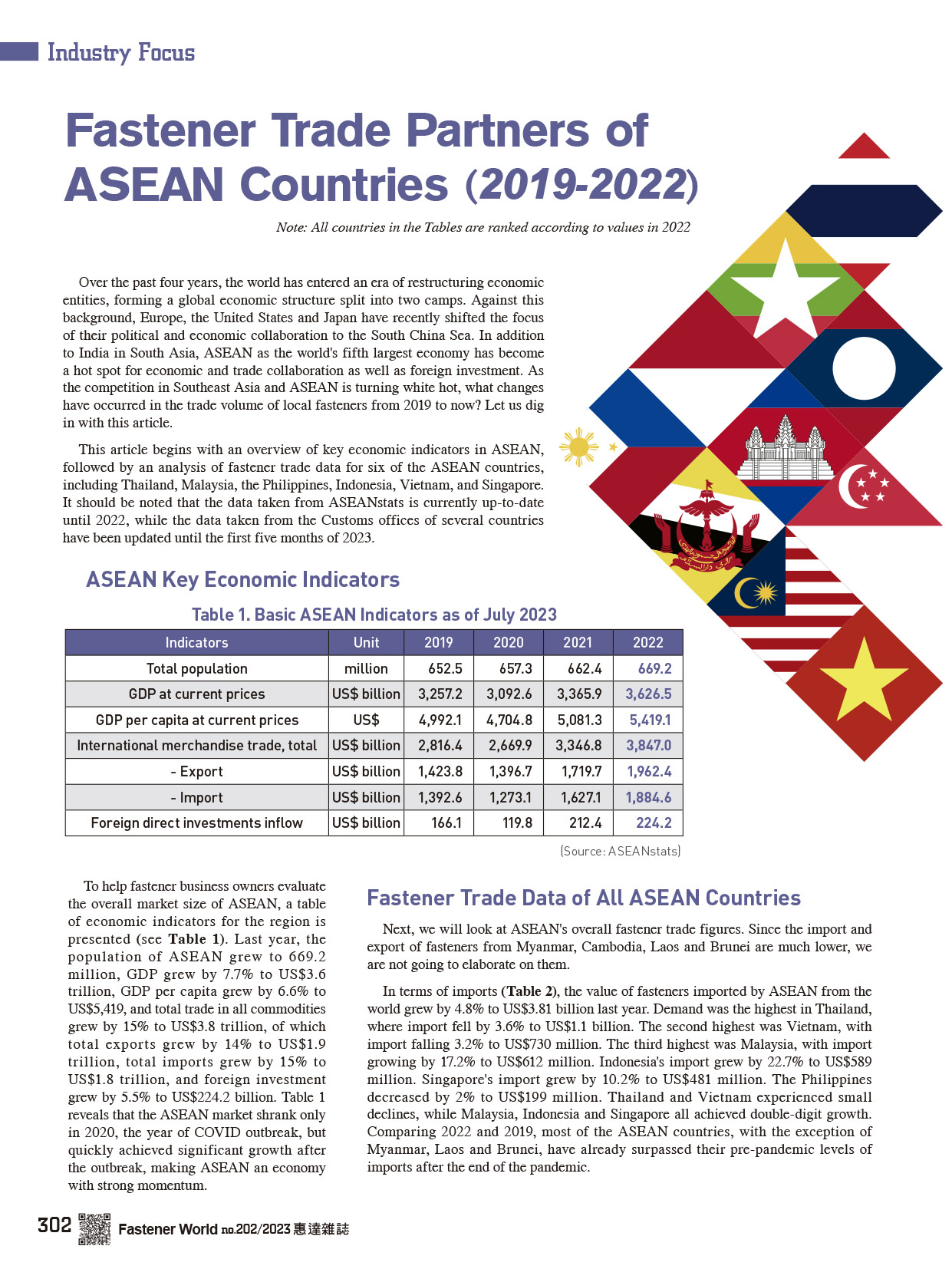

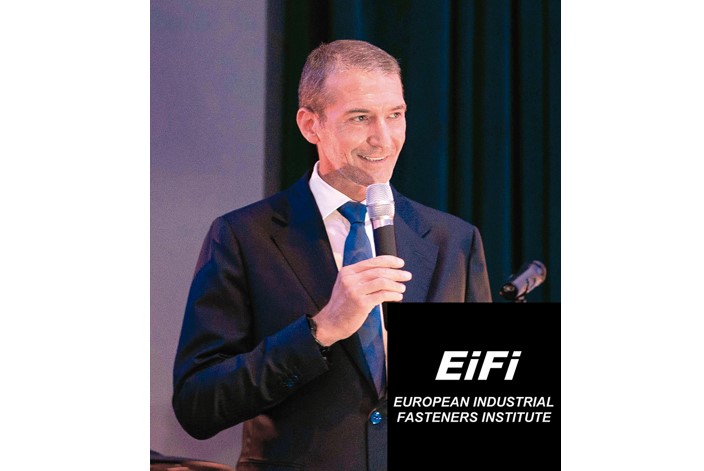

The E.I.F.I. has a New President— Interview with Paolo Pozzi

It is safe to say that Paolo Pozzi has earned his credentials in the field.

With a degree in Aerospace Engineering from the Politecnico Institute of Milan, he joined the Agrati Group in 1995, where he held various positions until becoming General Manager of the parent company "Agrati SpA" and then a member of the Board of Directors. He was appointed Managing Director of the Group in 2008 and CEO in 2016.

Under his leadership and in line with the Presidency, the Agrati Group has undergone a transformation that is clearly visible today through the achievement of important goals. These successes can be summarised by an annual turnover exceeding 680 million euros and a staff of more than 2400 employees operating across 12 manufacturing establishments situated in Europe, the United States and China.

Paolo Pozzi’s innate talent for diplomacy, coupled with his engaging personality, has garnered him recognition and respect within the social sphere of his profession, both nationally and internationally. He has carried out and continues to carry out intense professional and membership activities. Therefore, it came as no surprise when he was unanimously elected as EIFI President for the period of 2023-2027 during the EIFI General Shareholders’ Meeting held on 12 May 2023 in Meissen (Germany).

Thanks to his willingness to make time for us, we (referring to Italian Fasteners Magazine, the same goes hereinafter) had the privilege of meeting the recently appointed President. Here is the interview that followed.

What can we expect from your Presidency?

Firstly, I would once again like to express my heartfelt appreciation to all the EIFI Members who elected me as their President. It is with great honour and happiness that I assume this position, particularly as the EIFI is undergoing a significant period of transformation. My hope is to make a significant impact in shaping a new era for the EIFI and facilitating its adaptation to the challenges and profound changes currently affecting all industrial sectors.

I believe that it will become increasingly crucial to address these new challenges at the European level in order to effectively represent and safeguard the fasteners industry and its unique characteristics in the years to come.

This will necessitate an organisation capable of collaborating closely with national associations, while simultaneously expanding its operations and prominence at a European level. This can be accomplished by cultivating partnerships with institutions in Brussels (EC and Parliament), as well as other trade associations (AEGIS, CLEPA, EUROFER etc.). The present challenges cannot be addressed using the same approaches employed in the past.

What is the current organisational structure of the EIFI?

The current structure consists of a Board, which includes a President, two Vice-Presidents, six members representing the national associations and a General Manager. The term of office for the President and Board has been extended to four years and can be renewed for an additional term. There are three Market Groups:

• Automotive

• General Industry/Distribution

• Aerospace

There are three Operating Committees:

• Public Affairs, Legal, TDI and Membership Development

• Technical, Quality and Innovation

• Marketing and Communication

Two new categories have been introduced within the category of fastener manufacturers:

• Affiliated Members, comprising companies in the fasteners supply chain

• Associated Members, consisting mainly of service and consulting companies

What are your objectives as President during your term?

The objectives include:

1. Enhancing the recognition and visibility of the EIFI throughout Europe

2. Broadening the membership base

3. Strengthening the organisation

However, the fundamental objective remains the same: to effectively represent and protect the interests and unique characteristics of the European fasteners industry.

Is there still a valid role for a European trade association in today’s highly globalised world?

I would argue that because we have been living in a globalised world for more than 30 years, it is crucial to embrace the European dimension in order to tackle new challenges. This principle is applicable not only to trade associations but also to all EU Member States, who sometimes overlook the fact that they are part of a geographic region that represents the world’s largest market, renowned for excellence across all industrial sectors.

Even in the case of fasteners, Europe maintains its position as the world’s largest market, representing 26% of the total value of 90 billion dollars, surpassing the Asia Pacific region, North America and China. I believe it is worthwhile trying to defend and support this market as well as the European companies operating within it.

Are European nuts and bolts competitive at a global level?

What potential risks does this sector face in the future?

I would say that European nuts and bolts are indeed competitive globally, particularly when we compare ourselves to countries operating under similar regulations and conditions. Unfortunately, we are well aware that this level playing field is not always guaranteed.

I think that Europe’s position as the world’s leading fastener market can be attributed to the efforts of European manufacturers, and also to the supply chain, which over the years has adapted and evolved alongside market demands, offering manufacturers high-quality materials and services at competitive prices. Let us not forget that the competitiveness and expertise of European fastener manufacturers have allowed them to develop global champions who have also successfully invested in other regions worldwide. In fact, at least five European manufacturers rank among the world’s top ten fastener manufacturers.

The potential risks are partly known and partly new. The known risks include imbalances in relation to WTO regulations, which have led to the imposition of import duties to rebalance the system. The new risks stem from the disparities in the speed and approaches adopted by different regions worldwide to address sustainability concerns.

These concerns primarily revolve around the environment, with the first test case being the implementation of the CBAM (Carbon Border Adjustment Mechanism). However, this issue extends beyond environmental considerations and encompasses broader decisions linked to ESG issues, with each country adopting different approaches in this regard.

What can the EIFI do, particularly for small and medium-sized European companies in the fasteners sector?

In my view, small and medium-sized companies need to be part of an organisation that can effectively represent, defend and guide them in navigating the immense challenges of today. Consider the three major transformations currently taking place in Europe: sustainability, digitisation and the electrification of the automotive sector, which remains a key market for fastener manufacturers. These profound changes are having a significant impact on organisations, and the fact that they are all happening at the same time makes their management very complex and burdensome for large companies, while posing an unsustainable challenge for small and medium-sized enterprises. By sharing these epochal transitions with associations that can provide valuable information, support and guidance on addressing these challenges, I believe we can foster more cohesive and harmonious growth throughout the entire supply chain. This collaboration can help prevent disruptions and discontinuities that could potentially lead to significant issues, as demonstrated during the pandemic.

Currently, there is the prevailing belief that growth is the sole means to guarantee a company’s survival. In your opinion, what does this growth actually mean and how should it be achieved?

I do not think that growth is the only way to survive, but it is evident that stagnant or diminished corporate stature does not foster the development of champions capable of competing in a global and rapidly evolving environment such as the one we face today. Without growth, there is no investment and without investment, there is no innovation and no job creation.

Europe stands at the forefront in the battle against pollution in general, but this inevitably means placing limitations on economic and production activities. How do you propose reconciling this contradiction in a positive manner?

I believe that Europe’s environmental choices are correct, and no one, including companies, wants to oppose the transition. However, it appears that there has been an excessive focus on regulation, leaving little room for the development of a comprehensive strategy. While deadlines and potential sanctions have been set, the competitive landscape with American and Chinese companies seems to have been overlooked. The risk we face is that we are creating new rules for the game with highly skilled referees, only to find that others have taken the field ahead of us. This is true not only in the transition to electric vehicles, where Europe trails behind China, Korea and Japan in terms of accumulated battery technology, but also in the high-tech sector, where Europe faces a technological gap and lacks key players compared to countries like the United States and China. This contradiction could be resolved by greater collaboration between the European Commission and trade associations. Together they can work towards defining more comprehensive strategies that take into account the speed of transition and the negative effects it may bring in the short term. A prime example is the new regulations on car emissions with Euro 7 engines scheduled for July 2025. These regulations entail significantly higher costs than those initially estimated by the Commission, while providing limited environmental benefits.

We are currently witnessing a period of significant change and uncertainty, particularly in the automotive industry. What are your predictions in this regard? What role should the EIFI play in this context?

For quite some time now, I have believed that the transition to electric vehicles is irreversible. There is no turning back given the massive investments made by car manufacturers in Europe and globally. Recent growth figures have shown unexpected advancements not only in China but also in Europe, albeit at varying rates between northern and southern countries. The goal of achieving full electric private mobility in Europe by 2035, which may have seemed implausible a few years ago, has become more feasible. Since 2019 we have seen exponential growth in the market share of electrified vehicles, reaching 21% in 2022, with 9% being fully electric (BEV). Some Northern European countries, such as Norway, have already achieved an impressive 80% penetration rate. Evaluating how these countries have been able to reach such levels today will provide insights into the 2035 sustainability target for the whole of Europe. Uncertainty persists in the short term regarding the overall demand for cars, which will undoubtedly be negatively impacted by reduced credit availability, higher costs, the effects of a potential recession and relatively high price levels of electric vehicles, particularly in segments A and B.

When it comes to the evolution of the car, the EIFI will need to collaborate closely with other national and European automotive trade associations to address industry-specific challenges that may arise during this complex phase. One key challenge lies in effectively managing larger quantities and varieties of products, particularly for fastener manufacturers. This will necessitate diverse skills and the development of new processes to create new materials, coatings and components. Additionally, broader knowledge in areas beyond mechanics and metal materials will be essential. The demand for more diversified products will also lead to greater complexity in logistics management and distribution of products, as well as the need to converge towards standards that have yet to be defined. Lastly, over the coming years, components dedicated solely to internal combustion vehicles will gradually decline in volume, adversely affecting production costs due to diminished economies of scale, following a logic similar to what we have already seen for components used exclusively for diesel powertrains.

In the aftermath of a pandemic and with ongoing conflicts in various parts of the world, is it possible to maintain optimism and confidence in the future?

Unfortunately, wars and pandemics have always existed in the world and are part of human history and nature. Our generation has been fortunate enough to have avoided experiencing them directly. In particular, in the Western world, we have managed not to have wars for over 70 years, with the exception of the Balkan War in the 1990s. However, we now have one in the heart of Europe that increasingly involves us and seems to be taking on the form of a clash between the West and the rest of the world. This situation is disconcerting and fills us with unease and uncertainty, but I believe that maintaining a healthy balance of realism and optimism is the most prudent approach.

How would you like to conclude this interview?

With a closing remark that carries both a cautionary message and a ray of hope for companies of all sizes.

The world is changing fast. It is no longer a question of big overpowering small, but rather of the fast outpacing the slow.

(Text and photo provided by Marco A. Guerritore, Editor in Chief of Italian Fasteners Magazine)